Thai Money Laundering Tactics on Facebook: Regulatory Responses and Future Implications

The revised analysis of Thai money laundering operations on Facebook reveals sophisticated tactics, including fraudulent schemes and the use of corporate mule accounts. These operations have a substantial financial impact, with millions of baht laundered daily.

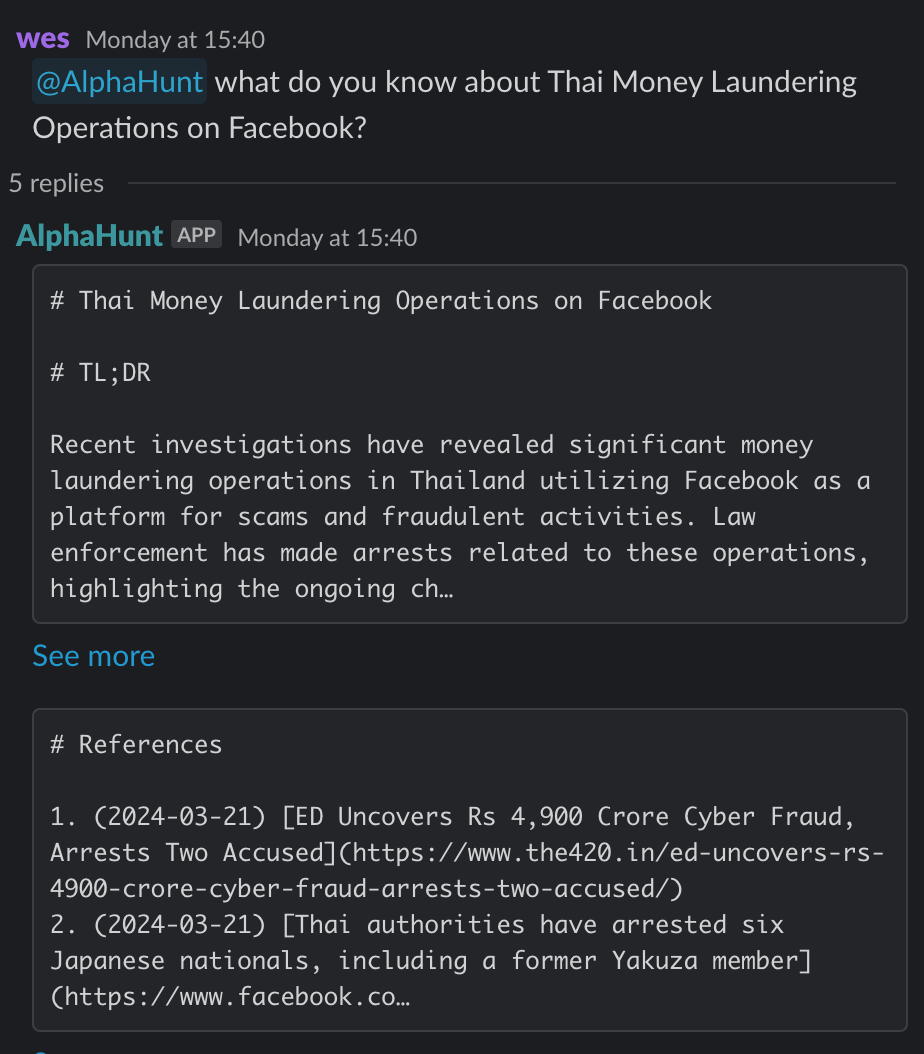

TL;DR

Key Points

-

- Thai money laundering operations on Facebook involve fraudulent schemes and corporate mule accounts.

- New anti-money laundering laws and enhanced screening measures are being implemented to combat these tactics.

-

- The financial impact is significant, with millions of baht laundered daily.

- Law enforcement is intensifying efforts to monitor and combat these activities.

-

- New legislation aims to strengthen financial integrity and improve transaction scrutiny.

- The Bank of Thailand is introducing guidelines to tackle digital fraud.

-

- Public awareness campaigns and collaborations with influencers are planned to educate citizens on online scams.

- Enhanced training for law enforcement is recommended to address evolving money laundering tactics.

Research

This analysis of Thai money laundering operations on Facebook reveals sophisticated tactics, including fraudulent schemes and the use of corporate mule accounts. These operations have a substantial financial impact, with millions of baht laundered daily. In response, Thailand has introduced new anti-money laundering legislation to enhance financial integrity and improve the scrutiny of transactions. The Bank of Thailand is also set to implement guidelines to combat digital fraud.

Public awareness campaigns are being planned to educate citizens about online scams, leveraging social media influencers to reach a broader audience. Additionally, enhanced training for law enforcement is recommended to equip officers with the skills needed to combat these crimes effectively.

In the short term, increased regulatory scrutiny and enforcement actions are expected, leading to more arrests and prosecutions. In the long term, money launderers may adapt their tactics, potentially using emerging social media platforms and advanced technologies to evade detection. International cooperation is anticipated to play a crucial role in combating cross-border money laundering activities.

Methods Used in Thai Money Laundering Operations on Facebook

- Fraudulent Schemes: Criminals utilize Facebook to promote various scams, including fake investment opportunities and counterfeit businesses. A recent case involved a network that laundered approximately 30 million baht daily through fraudulent online activities.

- Use of Corporate Mule Accounts: Launderers often create corporate mule accounts to facilitate transactions, making it difficult to trace the origins of funds. New measures have been introduced to enhance the screening of these accounts to prevent their misuse.

- Exploitation of Trust and Social Proof: Scammers build trust with potential victims by showcasing fake testimonials and success stories, often using social media influencers to lend credibility to their schemes.

Scale of Operations

- Financial Impact: The scale of money laundering operations in Thailand is substantial, with estimates indicating that millions of baht are laundered daily. A notable case involved a suspect in Chiang Rai who admitted to laundering 30 million baht per day for a call-center scam.

- Increased Activity: The rise in social media usage for financial crimes has prompted law enforcement to intensify their efforts in monitoring and combating these activities.

Legal and Regulatory Responses

- New Anti-Money Laundering Legislation: In March 2025, Thailand approved new anti-money laundering laws aimed at strengthening financial integrity. These laws include enhanced measures for identifying suspicious transactions and improving the integration of anti-money laundering systems.

- Measures Against Corporate Mule Accounts: Recent initiatives focus on suppressing corporate mule accounts used in money laundering and cybercrime. The Bank of Thailand is set to implement draft guidelines to tackle digital fraud and enhance the monitoring of these accounts.

- Impact of Regulatory Changes: The new legislation is expected to significantly impact future money laundering activities by increasing the scrutiny of financial transactions and enhancing cooperation between financial institutions and law enforcement.

Recommendations, Actions, Suggested Pivots, Forecasts and Next Steps..

(Subscribers Only)

![[FORECAST] Dismantled or Displaced? Cambodia’s Scam-Compound Crackdown by 2030?](/content/images/size/w600/2026/02/z-7.png)