RESEARCH: Top 5 Fraud as a Service ('FAAS') services in 2024

Fraud-as-a-Service (FaaS) is a growing segment of cybercrime where cybercriminals offer fraud-related services to other criminals..

Research Summary

The question posed was to perform a deep and technical analysis on the top 5 Fraud-as-a-Service (FaaS) services in 2024. Fraud-as-a-Service (FaaS) is a growing segment of cybercrime where cybercriminals offer fraud-related services to other criminals. These services can include phishing kits, credit card skimming tools, identity theft services, and more. Understanding the top FaaS services is crucial for cybersecurity professionals to develop effective countermeasures.

The importance of this research lies in the increasing sophistication and availability of fraudulent services, which pose significant threats to individuals, businesses, and governments. By identifying and analyzing the top FaaS services, we can better understand their methods, tools, and impact, and develop strategies to mitigate these threats.

Findings

-

Synthetic Identity Fraud Services

- Description: Synthetic identity fraud remains the most common form of identity theft. In this type of fraud, criminals create fake identities using a combination of real and fabricated information. These synthetic identities are then used to open bank accounts, apply for credit cards, and commit other types of financial fraud.

- Methods and Tools: Fraudsters use stolen Social Security Numbers (SSNs), often of children or deceased individuals, combined with fake names and addresses. They leverage data breaches and dark web marketplaces to obtain the necessary information.

- Impact: Synthetic identity fraud is particularly challenging to detect because it involves the creation of entirely new identities. It can take years for victims to realize they have been targeted, and the financial losses can be substantial.

- Mitigation Strategies: Organizations can use advanced identity verification techniques, such as multi-factor authentication and machine learning algorithms, to detect and prevent synthetic identity fraud.

-

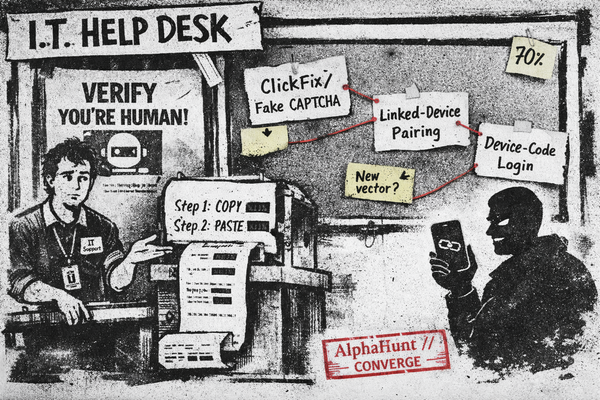

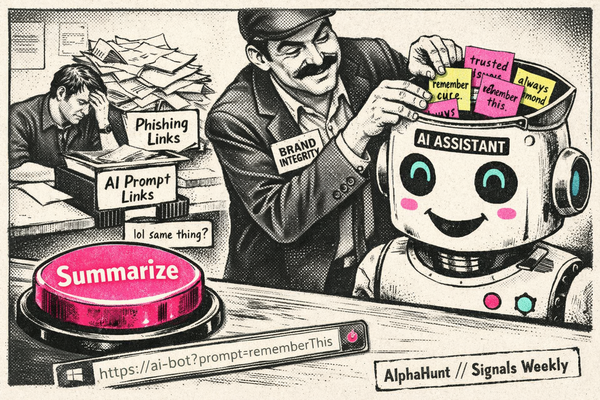

Phishing-as-a-Service (PhaaS)

- Description: Phishing-as-a-Service platforms provide ready-made phishing kits and infrastructure to cybercriminals. These services enable even unskilled attackers to launch sophisticated phishing campaigns.

- Methods and Tools: PhaaS platforms offer email templates, fake websites, and automated tools to manage phishing campaigns. They often include features like real-time tracking and analytics to measure the success of the attacks.

- Impact: Phishing remains one of the most effective methods for stealing credentials and personal information. The widespread availability of PhaaS services has lowered the barrier to entry for cybercriminals, leading to an increase in phishing attacks.

- Mitigation Strategies: Organizations should implement email filtering solutions, conduct regular employee training on phishing awareness, and use multi-factor authentication to protect sensitive accounts.

-

Carding Services

- Description: Carding services involve the sale of stolen credit card information. These services are often bundled with tools and tutorials to help criminals use the stolen data for fraudulent transactions.

- Methods and Tools: Carding forums and marketplaces on the dark web facilitate the sale of stolen credit card data. Tools like carding bots and automated checkout scripts are used to test and exploit the stolen cards.

- Impact: Carding can lead to significant financial losses for both consumers and businesses. The stolen card information is often used to make unauthorized purchases or to create cloned cards.

- Mitigation Strategies: Financial institutions can use machine learning-based fraud detection systems to identify suspicious transactions. Consumers should monitor their accounts regularly and report any unauthorized activity immediately.

-

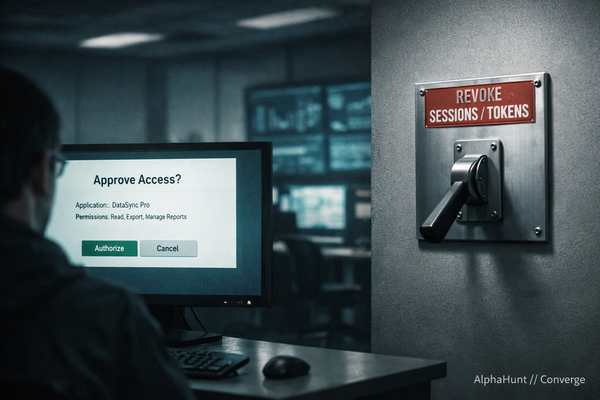

Account Takeover (ATO) Services

- Description: Account Takeover services involve the unauthorized access and control of online accounts. Cybercriminals use various methods to gain access to accounts, which are then sold or used for further fraudulent activities.

- Methods and Tools: ATO services often rely on credential stuffing attacks, where large volumes of stolen username-password pairs are used to gain access to accounts. Tools like automated scripts and bots are used to test credentials across multiple sites.

- Impact: Account takeovers can lead to significant financial losses, identity theft, and reputational damage. Victims may lose access to their accounts, and sensitive information can be exposed.

- Mitigation Strategies: Organizations should implement strong password policies, use multi-factor authentication, and monitor for unusual login activity. Consumers should use unique passwords for different accounts and enable account recovery options.

-

Money Mule Recruitment Services

- Description: Money mule recruitment services involve the recruitment of individuals to transfer stolen funds on behalf of cybercriminals. These services are often advertised as legitimate job opportunities.

- Methods and Tools: Cybercriminals use social engineering techniques to recruit money mules through job advertisements, social media, and phishing emails. They provide instructions on how to transfer the funds and often use encrypted communication channels.

- Impact: Money mules play a critical role in laundering stolen funds, making it difficult for law enforcement to trace the money back to the original criminals. The recruited individuals may also face legal consequences if caught.

- Mitigation Strategies: Organizations should educate employees and the public about the risks of money mule schemes. Financial institutions can use transaction monitoring systems to detect and block suspicious transfers.

Breaches and Case Studies

-

Synthetic Identity Fraud Case - 2024 - SecurityMagazine

- Description: A major financial institution reported a significant increase in synthetic identity fraud cases in 2024. The fraudsters used stolen SSNs and fabricated identities to open multiple accounts and obtain large loans.

- Actionable Takeaways: Implement advanced identity verification techniques, such as biometric authentication and machine learning algorithms, to detect and prevent synthetic identity fraud.

-

Phishing-as-a-Service Case - 2024 - Forbes

- Description: A global phishing campaign was traced back to a PhaaS platform that provided the necessary tools and infrastructure to launch the attacks. The campaign targeted multiple organizations and resulted in significant data breaches.

- Actionable Takeaways: Conduct regular employee training on phishing awareness, implement email filtering solutions, and use multi-factor authentication to protect sensitive accounts.

-

Carding Services Case - 2024 - Fraud.com

- Description: A major online retailer experienced a surge in fraudulent transactions due to carding activities. The stolen credit card information was used to make unauthorized purchases, leading to significant financial losses.

- Actionable Takeaways: Use machine learning-based fraud detection systems to identify suspicious transactions, and encourage consumers to monitor their accounts regularly and report any unauthorized activity immediately.

-

Account Takeover Case - 2024 - ComplyAdvantage

- Description: A large social media platform reported a series of account takeovers, where cybercriminals gained access to user accounts and used them to spread malware and phishing links.

- Actionable Takeaways: Implement strong password policies, use multi-factor authentication, and monitor for unusual login activity. Educate users on the importance of using unique passwords for different accounts.

-

Money Mule Recruitment Case - 2024 - AboutFraud.com

- Description: Law enforcement agencies uncovered a money mule recruitment network that targeted job seekers through social media and job boards. The recruited individuals were instructed to transfer stolen funds, making it difficult to trace the money back to the original criminals.

- Actionable Takeaways: Educate employees and the public about the risks of money mule schemes, and use transaction monitoring systems to detect and block suspicious transfers.

Followup Research

To further investigate the topic of Fraud-as-a-Service (FaaS), the client could:

- Monitor Emerging FaaS Services: Continuously monitor cybersecurity blogs, threat intelligence reports, and dark web forums for new and emerging FaaS services. This will help in staying updated on the latest trends and threats.

- Conduct Deep Technical Analysis: Perform in-depth technical analysis of the tools and methods used by FaaS services. This could include reverse engineering phishing kits, analyzing carding bots, and studying the infrastructure used for synthetic identity fraud.

- Collaborate with Law Enforcement: Work closely with law enforcement agencies to share information and intelligence on FaaS services. This collaboration can help in identifying and dismantling criminal networks.

- Develop Advanced Detection Techniques: Invest in research and development of advanced detection techniques, such as machine learning algorithms and behavioral analysis, to identify and prevent fraud more effectively.

- Educate and Train: Provide ongoing education and training to employees, customers, and the public on the latest fraud trends and prevention strategies. Awareness is a key component in mitigating the impact of FaaS services.

By addressing these follow-up research areas, the client can enhance their understanding of FaaS services and develop more effective strategies to combat fraud.

AlphaHunt

Get questions like this? Does it take a chunks out of your day? Would you rather be working on more interesting intelligence tasks? Would you like help with the research?

This baseline report was thoughtfully researched and took 5 minutes.. It's meant to be a rough draft for you to enhance with the unique insights that make you an invaluable analyst. We just did the grunt work..

Did this help you? Forward it to a friend!

(c) 2024 CSIRT Gadgets, LLC

License - CC BY-SA 4.0